Working to lower out-of-pocket expenses for patients

Doctor Trusted Patient Preferred

Latest technology, fast results, convenient locations

Online Bill Payment

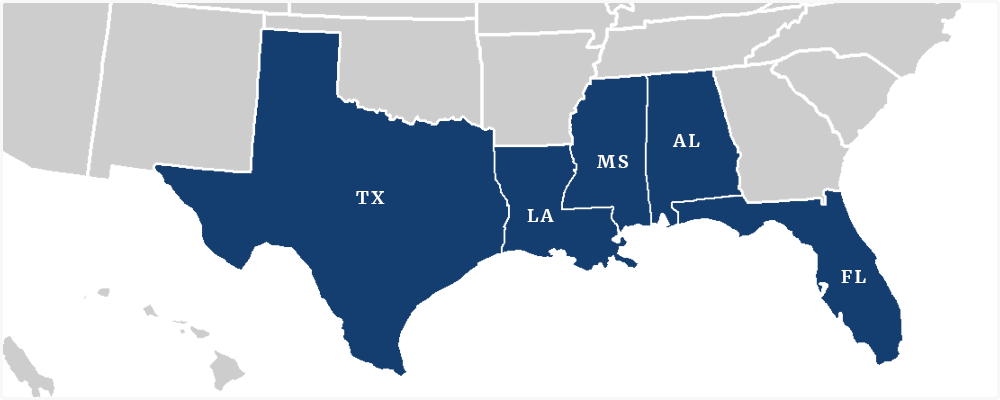

Find the Location Near You

Click on any of our locations to learn more about services offered, hours of service and general contact information.

Select your state from above or use this search field

Found Locations

View All Locations

M.R. Imaging Systems – Alexandria LA

211 N 3rd St #B

Alexandria LA 71301

Alexandria LA 71301

(318) 443-7674 - Appointment

(318) 443-7696 - Fax

More Info

Open Air MRI of CENLA – Alexandria LA

5413 Jackson Street Ext

Alexandria LA 71303

Alexandria LA 71303

(318) 445-6736 - Appointment

(318) 445-8845 - Fax

More Info

Alliance – Lake Jackson

2760 Brazos Parkway. Suite B&C

Angleton, TX 77515

Angleton, TX 77515

(979) 849-5700 - Appointment

(979) 849-5787 - Fax

More Info

Baton Rouge Imaging Center – Baton Rouge LA

8044 Summa Ave

Baton Rouge LA 70809

Baton Rouge LA 70809

(225) 761-7278 - Appointment

(225) 767-8121 - Fax

More Info

Bluebonnet Imaging Center – Baton Rouge LA

4570 Bluebonnet Blvd #A

Baton Rouge LA 70809

Baton Rouge LA 70809

(225) 298-3223 - Appointment

(225) 298-5474 - Fax

More Info

Central Imaging Center – Baton Rouge LA

11424 Sullivan Rd Bldg B #C

Baton Rouge LA 70818

Baton Rouge LA 70818

(225) 261-7401 - Appointment

(225) 261-3561 - Fax

More Info

PARS Imaging – Baytown TX

1010 W Baker Rd #101

Baytown TX 77521

Baytown TX 77521

(281) 427-5555 - Appointment

(281) 422-7769 - Fax

More Info

Imaging Center of Columbus – Columbus MS

2526 5th St N

Columbus MS 39705

Columbus MS 39705

(662) 328-8402 - Appointment

(662) 328-1554 - Fax

More Info

Radiology & Imaging – Alameda – Corpus Christi, TX

3226 S Alameda St

Corpus Christi, TX 78404

Corpus Christi, TX 78404

(361) 888-8875 - Appointment

(361) 881-6210 - Fax

More Info

Radiology & Imaging – South – Corpus Christi, TX

2825 Spohn South Dr

Corpus Christi, TX 78414

Corpus Christi, TX 78414

(361) 888-8875 - Appointment

(361) 881-6210 - Fax

More Info

Diagnostic Imaging Services – Covington, LA Highway 21

71154 Highway 21

Covington LA 70433

Covington LA 70433

(985) 641-2390 - Appointment

(985) 641-2854 - Fax

More Info

Diagnostic Imaging Services – Covington, LA Pinnacle Parkway

1200 Pinnacle Pkwy #5

Covington LA 70433

Covington LA 70433

(985) 641-2390 - Appointment

(985) 641-2854 - Fax

More Info

Heritage Diagnostic Center – Cullman AL

1705 Main Ave SW #C

Cullman AL 35055

Cullman AL 35055

(256) 734-8175 - Appointment

(256) 734-6296 - Fax

More Info

Open MRI of Mississippi – Flowood MS

2630 Courthouse Cir #A

Flowood MS 39232

Flowood MS 39232

(601) 487-8274 - Appointment

(601) 487-8701 - Fax

More Info

Ascension Open MRI – Gonzales LA

2622 S Ruby Ave

Gonzales LA 70737

Gonzales LA 70737

(225) 450-6125 - Appointment

(225) 450-6327 - Fax

More Info

Open MRI of Hammond – Hammond LA

42078 Veterans Ave #F

Hammond LA 70403

Hammond LA 70403

(985) 340-1960 - Appointment

(985) 340-1967 - Fax

More Info

Homosassa Open MRI – Homosassa FL

8464 W Aquaduct St

Homosassa FL 34448

Homosassa FL 34448

(352) 628-4800 - Appointment

(352) 628-4801 - Fax

More Info

Houston Premier Radiology Center – Houston, TX

12853 Gulf Freeway

Houston, TX 77034

Houston, TX 77034

(281) 464-8200 - Appointment

(281) 464-4343 - Fax

More Info

Alliance – Lake Houston

5514 Atascocita Rd. #180

Humble, TX 77346

Humble, TX 77346

(832) 644-0148 - Appointment

(832) 924-7962 - Fax

More Info

Alliance – Katy

21800 Katy Fwy,

#140

Katy, TX 77449

#140

Katy, TX 77449

(281) 769-8385 - Appointment

(281) 547-7487 - Fax

More Info

Advanced Imaging of Lafayette – Lafayette LA

935 Camellia Blvd #101

Lafayette LA 70508

Lafayette LA 70508

(337) 984-2036 - Appointment

(337) 984-7604 - Fax

More Info

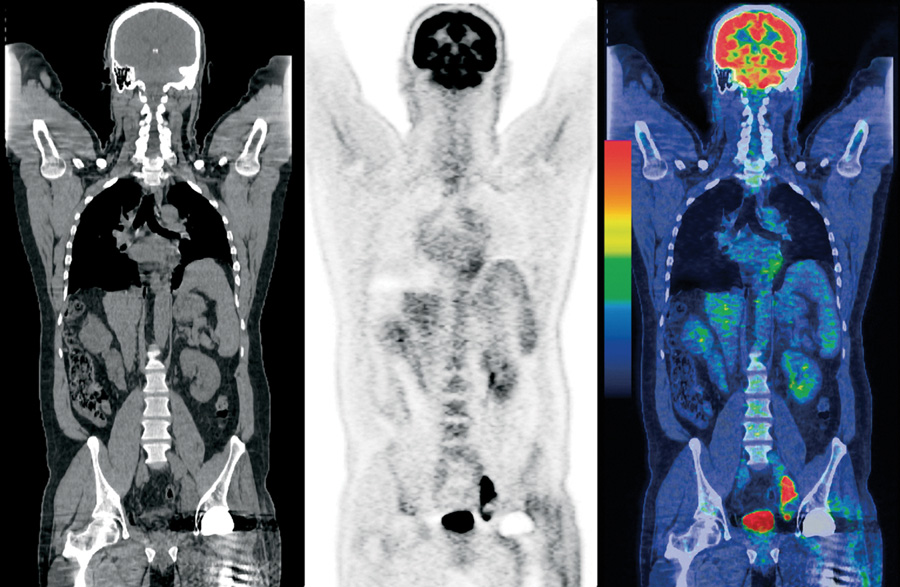

Louisiana PET/CT Imaging of Lake Charles – Lake Charles LA

831 Lakeshore Dr

Lake Charles LA 70601

Lake Charles LA 70601

(337) 433-3001 - Appointment

(337) 433-0540 - Fax

More Info

River Bend Imaging – Laplace LA

490 Belle Terre Blvd

Laplace LA 70068

Laplace LA 70068

(985) 359-7226 - Appointment

(985) 359-0323 - Fax

More Info

Diagnostic Imaging Services – Marrero, LA

925 Avenue C

Marrero LA 70072

Marrero LA 70072

(504) 883-5999 - Appointment

(504) 883-5364 - Fax

More Info

Imaging Center of Meridian – Meridian MS

2021 24th Ave #B

Meridian MS 39301

Meridian MS 39301

(601) 483-4339 - Appointment

(601) 483-4516 - Fax

More Info

Diagnostic Imaging Services – Metairie, LA Houma Boulevard

3434 Houma Blvd #100

Metairie LA 70006

Metairie LA 70006

(504) 883-5999 - Appointment

(504) 883-5364 - Fax

More Info

Diagnostic Imaging Services – Metairie, LA Veterans Boulevard

4241 Veterans Memorial Blvd #100

Metairie LA 70006

Metairie LA 70006

(504) 883-5999 - Appointment

(504) 883-5364 - Fax

More Info

Doctors Imaging – Metairie LA

4204 Teuton St

Metairie, LA 70006

Metairie, LA 70006

(504) 883-8111 - Appointment

(504) 883-3555 - Fax

More Info

Northeast Imaging – Monroe LA

1703 Lamy Ln

Monroe LA 71201

Monroe LA 71201

(318) 570-4985 - Appointment

(318) 450-4040 - Fax

More Info

Alliance – Woodforest

Woodforest Medical Plaza 1

Suite 180

750 Fish Creek Thoroughfare

Montgomery, TX 77316

Suite 180

750 Fish Creek Thoroughfare

Montgomery, TX 77316

(936) 647-2538 - Appointment

(936) 207-1358 - Fax

More Info

Southern Imaging Specialists – Montgomery AL

465 Saint Lukes Dr

Montgomery AL 36117

Montgomery AL 36117

(334) 279-8370 - Appointment

(334) 279-8572 - Fax

More Info

Alliance – Pearland

1910 Country Place Pkwy, Ste 154

Pearland, TX 77584

Pearland, TX 77584

(832) 344-0008 - Appointment

(832) 344-0009 - Fax

More Info

Northwest Imaging – Shreveport LA

1460 E Bert Kouns Industrial Loop #708

Shreveport LA 71105

Shreveport LA 71105

(318) 425-1001 - Appointment

(318) 425-5001 - Fax

More Info

Diagnostic Imaging Services – Slidell, LA

1310 Gause Blvd

Slidell, LA 70458

Slidell, LA 70458

(985) 641-2390 - Appointment

(985) 641-2854 - Fax

More Info

Alliance – Spring

20639 Kuykendahl Rd, Ste 250

Spring, TX 77379

Spring, TX 77379

(832) 610-3305 - Appointment

(832) 514-3647 - Fax

More Info

Texarkana PET/CT imaging Institute – Texarkana TX

1929 Moores Ln

Texarkana TX 75503

Texarkana TX 75503

(903) 794-1994 - Appointment

(903) 794-1996 - Fax

More Info

Alliance – The Woodlands

1011 Medical Plaza Dr, Ste 120,

The Woodlands, TX 77380

The Woodlands, TX 77380

(281) 305-3003 - Appointment

(281) 305-3004 - Fax

More Info

Diagnostic Imaging Services – Thibodaux, LA

2100 Audubon Ave

Thibodaux, LA 70301

Thibodaux, LA 70301

(985) 641-2390 - Appointment

(985) 641-2854 - Fax

More Info

Vestavia Hills Imaging Center – Vestavia Hills AL

2017 Canyon Rd #25

Vestavia Hills AL 35216

Vestavia Hills AL 35216

(205) 824-8262 - Appointment

(205) 824-8264 - Fax

More Info

Alliance – Clear Lake

17490 Hwy 3 Ste. B300

Webster, TX 77598

Webster, TX 77598

(713) 351-4976 - Appointment

(713) 263-3534 - Fax

More Info

Alliance – Montgomery County

9851 FM 1097 Rd West

Willis, TX 77318

Willis, TX 77318

(936) 254-8402 - Appointment

(936) 249-2251 - Fax

More Info

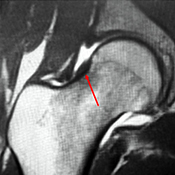

Women’s Health Imaging

Caring, compassionate and friendly. That’s how women often describe the Capitol Imaging Services women’s imaging team. Select centers offer comprehensive imaging services crucial to women’s health, including breast cancer screening.

Learn More

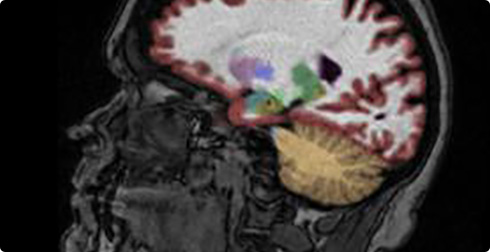

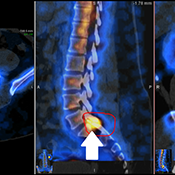

Neuroimaging

Neuroimaging produces images of the brain without requiring surgery, incision of the skin or any direct contact with the inside of the body. DIS offers three specialized neuroimaging studies: DaTscan, NeuroQuant Volumetric MRI and Diffusion Tensor Imaging.Learn More

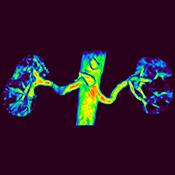

Prostate MRI

Let's be brief. Prostate 3T MRI offers men a noninvasive imaging technique that better detects the suspicion and extent of prostate cancer. Better detection assists surgeons in planning for minimally invasive surgery or taking a more deliberate wait-and-see approach.Learn More

Save money on healthcare!

The hospital told Miss Veronica her pelvic ultrasound would cost $400 under her insurance plan. She contacted Capitol Imaging Services and was told she was totally covered by her plan with no additional cost! Talk to us before making any decision to go to the hospital.

Learn More

Price Comparison

Potential savings based on average regional hospital pricing

ct scan

FLOUROSCOPY

DEXA BONE DENSITY

MAMMOGRAPHY

MRI

ULTRASOUND

Schedule a Visit to CIS

Call or email us to schedule a visit Capitol Imaging Services for a recommended screening or diagnostic exam. We will contact you to arrange for an appointment at one of our convenient locations.

View Locations

Contact Us

Locations

Convenient locations near you